Explore the world of crypto exchanges and learn the key differences between DEXs (Decentralized Exchanges) and CEXs (Centralized Exchanges). This guide covers their features, advantages, and disadvantages, helping you choose the right platform for your needs.

Differences Between DEX and CEX: Cryptocurrency Exchanges Requiring No Identity Verification

Cryptocurrency exchanges can be broadly categorized into two types:

- DEX (Decentralized Exchanges) with no centralized management.

- CEX (Centralized Exchanges) with centralized management.

What is DEX (Decentralized Exchange)?

A DEX (Decentralized Exchange) is a type of exchange where no centralized authority exists. Users can conduct transactions directly by simply connecting their wallets. This system enhances transparency in transactions and reduces intermediary fees. Additionally, DEXs offer high flexibility, allowing anyone to access and use them freely.

Furthermore, DEXs leverage blockchain technology to ensure transaction security and reliability. Users connect their wallets and manage their assets independently, eliminating risks posed by relying on third-party asset management.

What is CEX (Centralized Exchange)?

A CEX (Centralized Exchange) is an exchange where the operators manage user assets. While intermediary fees are incurred, large exchanges often have high trading volumes and liquidity, making transactions quicker to execute. Prominent exchanges such as Bybit and Binance fall under this category, as they are operated by companies.

Using a CEX typically requires users to provide personal information and identity verification documents. Additionally, the private keys to wallets are managed by the exchange itself, concentrating security risks. If the exchange’s security measures are inadequate, the risk of cyberattacks increases.

Pros and Cons of Using DEX

Pros:

- No identity verification is required; transactions can be made by simply connecting a wallet.

- Transaction fees are lower compared to CEX.

- Tokens not listed on CEXs can be traded.

- Risk of hacking can be avoided by securing private keys.

Cons:

- Deposits and withdrawals in fiat currency are not possible.

- Customer support is less convenient than CEX.

- Scam coins can be easily traded.

- Usage might suddenly be restricted due to legal regulations.

Notable DEX Examples

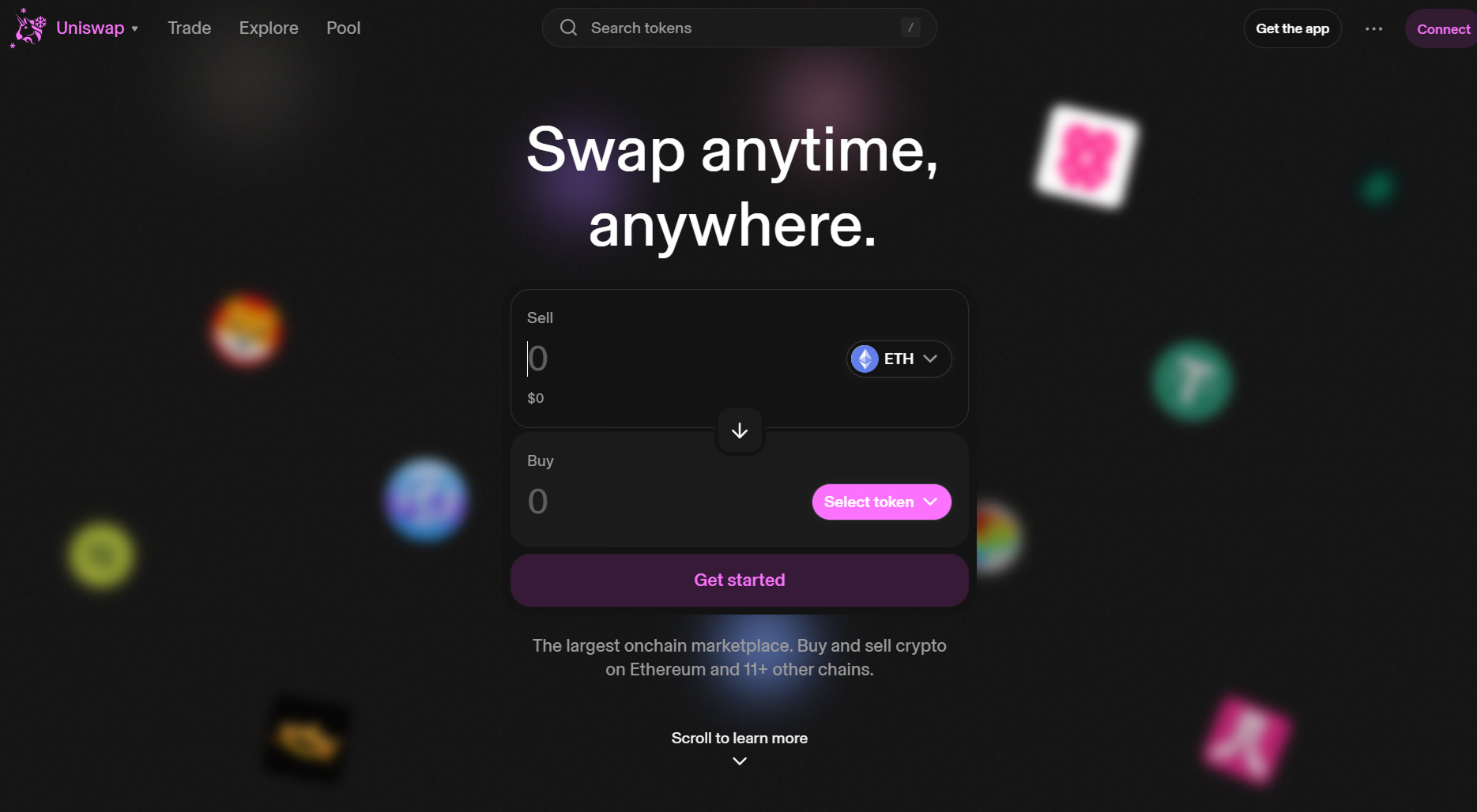

Uniswap

According to the price-tracking website CoinMarketCap, Uniswap ranks first in terms of 24-hour trading volume among DEXs. It is based on the Ethereum chain and issues a governance token called UNI.

PancakeSwap

This platform features unique functionalities, such as using the governance token CAKE to purchase lottery tickets. PancakeSwap is based on the BNB chain.

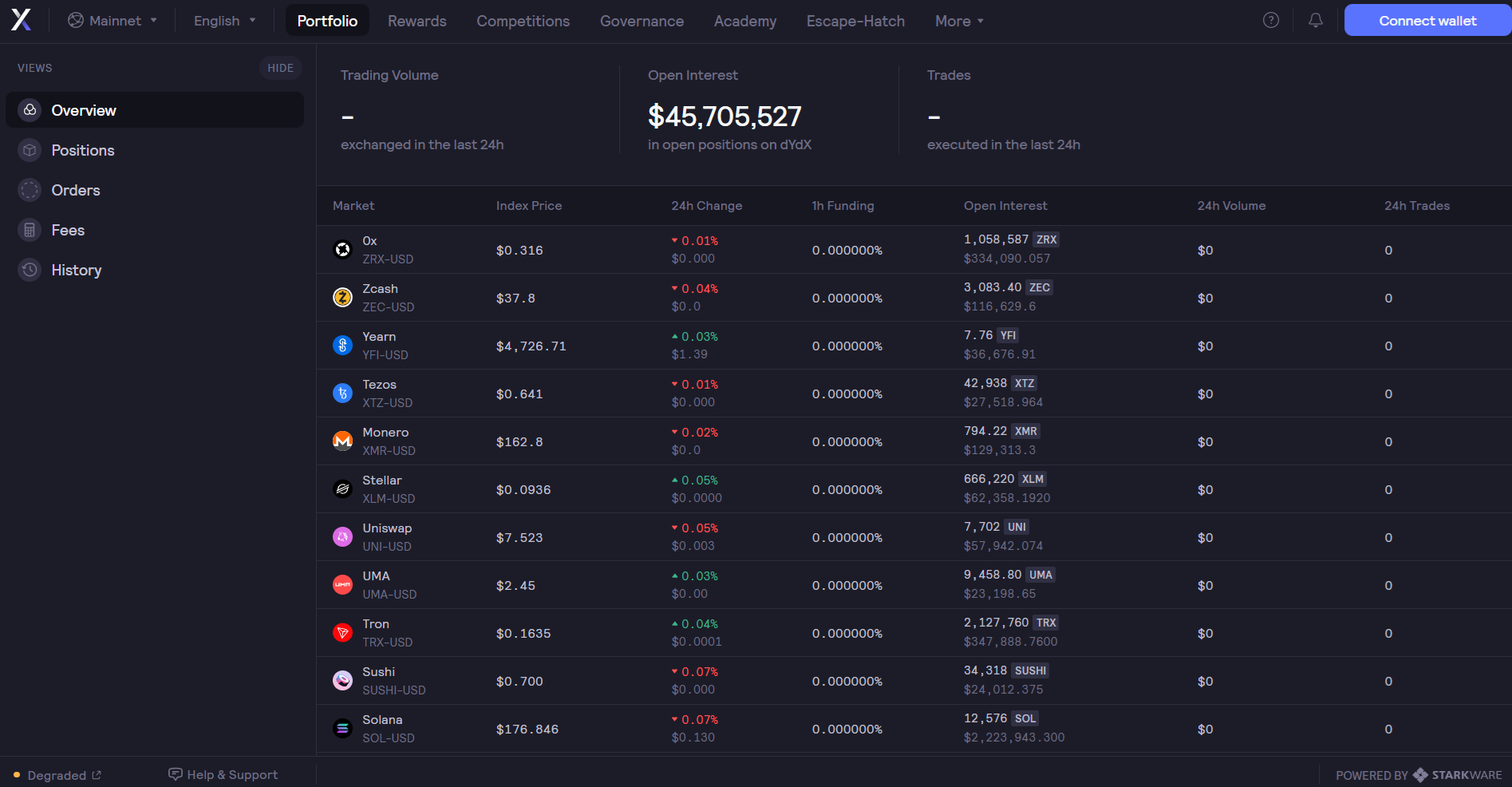

dYdX

Specializing in perpetual futures trading, dYdX does not offer spot trading. It issues a governance token called DYDX and is based on the Cosmos blockchain. Its user interface resembles that of a CEX.